Technical Report 260, c4e-Preprint Series, Cambridge

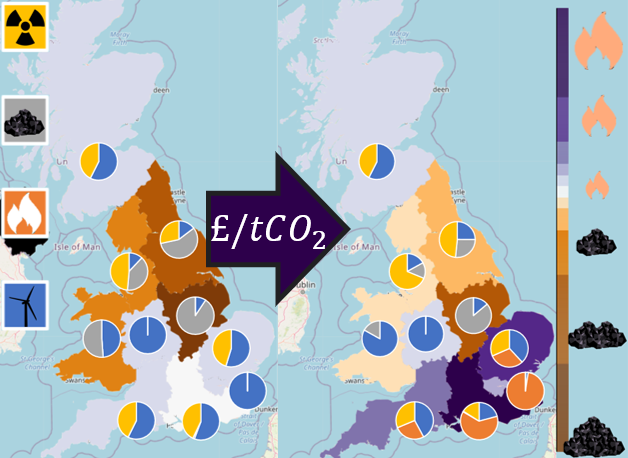

How does a Carbon Tax affect Britain’s Power Generation Composition?

Reference: Technical Report 260, c4e-Preprint Series, Cambridge, 2020

- OPF modelling performed at national and regional levels.

- Effect of different carbon tax rates on generator composition determined.

- Transmission losses accelerate coal to gas transition due to generator placement.

- Differences in regional generator compositions and loads found to be significant.

The purpose of this paper is to determine the effect of different carbon tax rates on the power generation composition of Britain. This was accomplished via a regional model which considered both the differences in regional capacity by generator type as well as the high voltage transmission constraints and losses incurred by inter-regional power flows. This regional model is also compared to a pure dispatch aggregated model which considers only costs on the generator side (no transmission losses resulting from a regional breakdown) inclusive of the carbon tax. The effect of this tax is a transition from coal to combined cycle gas turbine (CCGT) generated power to fulfil demand unmet by nuclear or renewable sources. Due regional differences in demand and installed capacity technology types it is determined that more than 50% of this transition occurs prior to CCGT becoming more economical than coal from a pure dispatch perspective. Thus, due to CCGT generators typically being closer to larger southern loads than northern coal, transmission losses and the economic disincentive of a carbon tax combine in encouraging this transition.

The purpose of this paper is to determine the effect of different carbon tax rates on the power generation composition of Britain. This was accomplished via a regional model which considered both the differences in regional capacity by generator type as well as the high voltage transmission constraints and losses incurred by inter-regional power flows. This regional model is also compared to a pure dispatch aggregated model which considers only costs on the generator side (no transmission losses resulting from a regional breakdown) inclusive of the carbon tax. The effect of this tax is a transition from coal to combined cycle gas turbine (CCGT) generated power to fulfil demand unmet by nuclear or renewable sources. Due regional differences in demand and installed capacity technology types it is determined that more than 50% of this transition occurs prior to CCGT becoming more economical than coal from a pure dispatch perspective. Thus, due to CCGT generators typically being closer to larger southern loads than northern coal, transmission losses and the economic disincentive of a carbon tax combine in encouraging this transition.

Material from this preprint has been published in Applied Energy.

PDF (3.0 MB)