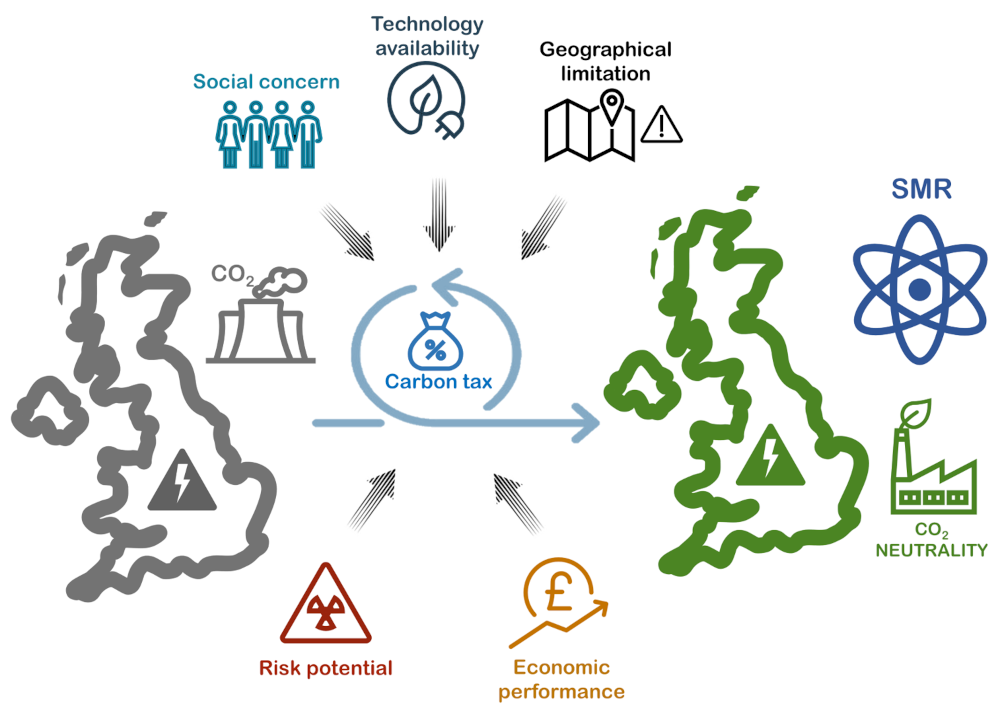

A nuclear future? Small Modular Reactors in a carbon tax-driven transition to clean energy

- Investigated carbon tax to motivate adoption of small modular reactors (SMRs)

- Data-driven investigation of policy trade-offs for placement of SMRs

- Pareto front between objectives to minimise risk and transmission loss

- Investigated carbon tax to motivate adoption of small modular reactors (SMRs)

The study investigated the effect of a CO2 tax to encourage the adoption of Small Modular Reactors (SMRs) as an alternative to fossil fuels for power generation in the UK. The trade-offs of different SMR placement policy options with respect to the competing objectives of minimising transmission losses and population risk were investigated to understand the impact on the optimal placement and usage of SMRs at different carbon tax levels. Different assumptions about renewable power availability were explored. The study identified the most cost-effective number of SMRs per site and optimised the power flow for cost efficiency. Regardless of renewable power availability, a carbon tax in the range of £45–60/t was found to incentivise the full adoption of SMRs with a levelised cost of electricity of £60/MWh versus £0–20/t at £40/MWh. The SMR placement influenced the performance and cost of the energy system, as well as whether a region acted as a net importer or exporter of energy. The most cost-effective solutions were achieved by balancing transmission loss and population risk.

The study investigated the effect of a CO2 tax to encourage the adoption of Small Modular Reactors (SMRs) as an alternative to fossil fuels for power generation in the UK. The trade-offs of different SMR placement policy options with respect to the competing objectives of minimising transmission losses and population risk were investigated to understand the impact on the optimal placement and usage of SMRs at different carbon tax levels. Different assumptions about renewable power availability were explored. The study identified the most cost-effective number of SMRs per site and optimised the power flow for cost efficiency. Regardless of renewable power availability, a carbon tax in the range of £45–60/t was found to incentivise the full adoption of SMRs with a levelised cost of electricity of £60/MWh versus £0–20/t at £40/MWh. The SMR placement influenced the performance and cost of the energy system, as well as whether a region acted as a net importer or exporter of energy. The most cost-effective solutions were achieved by balancing transmission loss and population risk.

- This paper draws from preprint 312: A nuclear future? Small Modular Reactors in a carbon tax-driven transition to clean energy

- Access the article at the publisher: DOI: doi.org/10.1016/j.apenergy.2024.123128