Technical Report 203, c4e-Preprint Series, Cambridge

Exploiting arbitrage opportunities on commodity futures market as a chemical plant

Reference: Technical Report 203, c4e-Preprint Series, Cambridge, 2018

- An implementation of an automated arbitrage spotter powered by market and physical data is presented.

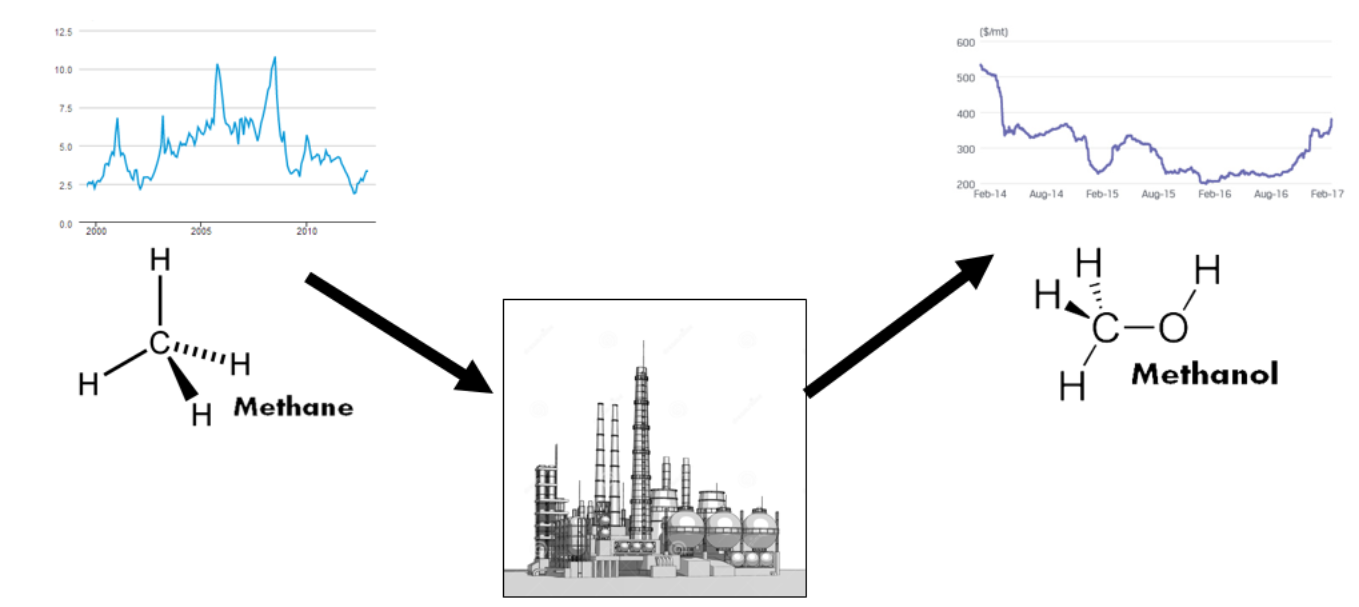

- Two specific applications are considered: conversion of natural gas to methanol and crude palm oil to biodiesel.

- Analysis based on futures market data from 11.06.2018 indicates that profit can be made by arbitration of crude palm oil to biodiesel.

This paper presents an implementation of an automated arbitrage spotter powered by market and physical data applied to two scenarios: conversion of natural gas to methanol and crude palm oil to biodiesel. The programme searches for opportunities to make additional profit by analysing the futures market prices for both the reagent and the product. It considers cost of storage and conversion (other feedstock, steam, electricity and other utilities) derived from physical simulations of the chemical process. It is assumed that the plant is located in Singapore and operates with a long-term production contract. Two scenarios considered are natural gas-to-methanol conversion and crude palm oil-to-biodiesel (FAME) conversion. Analysis conducted on 11.06.2018 in the former scenario no trade should be made in order to avoid making a loss. However, in the latter case up to 219.28 USD per tonne of biodiesel can be earned by buying contracts for delivery of crude palm oil in July 2018 and selling contracts for delivery of biodiesel in August 2018 in a ratio of 4 to 1. It is shown that there may be a realistic scope for increasing profitability of a chemical plant by exploiting the opportunities across different commodity markets in an automated manner. Additionally, the results suggest that direct arbitrage with natural gas may not be possible as the markets are efficient and transporting natural gas tends to be more expensive than methanol.

This paper presents an implementation of an automated arbitrage spotter powered by market and physical data applied to two scenarios: conversion of natural gas to methanol and crude palm oil to biodiesel. The programme searches for opportunities to make additional profit by analysing the futures market prices for both the reagent and the product. It considers cost of storage and conversion (other feedstock, steam, electricity and other utilities) derived from physical simulations of the chemical process. It is assumed that the plant is located in Singapore and operates with a long-term production contract. Two scenarios considered are natural gas-to-methanol conversion and crude palm oil-to-biodiesel (FAME) conversion. Analysis conducted on 11.06.2018 in the former scenario no trade should be made in order to avoid making a loss. However, in the latter case up to 219.28 USD per tonne of biodiesel can be earned by buying contracts for delivery of crude palm oil in July 2018 and selling contracts for delivery of biodiesel in August 2018 in a ratio of 4 to 1. It is shown that there may be a realistic scope for increasing profitability of a chemical plant by exploiting the opportunities across different commodity markets in an automated manner. Additionally, the results suggest that direct arbitrage with natural gas may not be possible as the markets are efficient and transporting natural gas tends to be more expensive than methanol.

Material from this preprint has been published in Industrial & Engineering Chemistry Research.

PDF (1.7 MB)